Bitcoin

Impact of Kazakhstan on Bitcoin Miners

How have bitcoin miners reacted to Kazakhstan’s recently implemented regulations?

Kazakhstan is the latest country to create Bitcoin mining regulations. While there was no law the Kazakhstan government simply shut down The internet in Kazakhstan because of the large Bitcoin mining farms, that dud led to a drop off in the mining rate. According to a Bitcoin hash rate distribution chart, Kazakhstan contributed 20% of the Bitcoin hash rate throughout the second half of 2021 and fell to a reported 13.4% after the demonstrations. In response to the drop in hash rate, the Kazakhstan government has implemented new regulations to control and monitor Bitcoin mining activities. These regulations aim to ensure that Bitcoin mining operations are conducted in a sustainable and responsible manner. As a result, miners in Kazakhstan will need to adhere to strict guidelines and requirements in order to continue their bitcoin mining time.

Back in 2021: China Crypto Ban

What was the intended effect of China’s moratorium on mining, which took place in mid-2021 and resulted in mining operations moving to the United States among other countries? See also our article on the China ban from 2021.

Pro-Bitcoin Spanish Legislator María Muñoz

A Spanish lawmaker is pushing to turn Spain into a bitcoin mining hotspot. Pro-Bitcoin Spanish legislator María Muñoz encourages Bitcoin miners from Kazakhstan to establish themselves in Spain. When it comes to cryptocurrencies, María Muñoz is no novice. Her political party suggested a national cryptocurrency plan in October 2021, demonstrating her support for the Bitcoin network.

There are no laws prohibiting Bitcoin in Spain. The introduced bill aims to make Spain a Bitcoin mining hotspot in order to attract Bitcoin miners from the protests going on in Kazakhstan. It contains several suggestions for how Spain might entice Bitcoin miners fleeing from Kazakhstan to relocate there. Muñoz began by detailing the importance of the Kazakhstani demonstrations and how the government was compelled to shut down all internet access. The bill demonstrated how cryptocurrencies had a significant impact on Spain’s economy throughout the year, despite the lack of government-endorsed rules.

While some think that is this one of the main reasons driving the price of Bitcoin down to $40k I did see another more logical reason, the shutdown of the Kazakhstan internet did do only one thing similar to what happened when China executed the ban, the yield went up.

As with the China ban, this event shows how powerful the Bitcoin blockchain is in resilience, taking a large portion of the blockchain did not impact the Proof of Work Blockchain that runs Bitcoin. Bitcoin miners are rewarded for their participation in Bitcoin’s Proof of Work with new Bitcoin, so when the difficulty goes up as it did in January 2021 and February 2021, the Bitcoin rewards go down.

Bitcoin miners flee to other countries to continue mining operations like they have done in China and now Kazakhstan. These events show how powerful blockchain technology is and how it cannot be shut down by anyone government. Bitcoin will continue to grow and be used more throughout the world.

Conclusion

Kazakhstan is the latest country to create Bitcoin mining regulations. While there was no law the Kazakhstan government simply shut down The internet in Kazakhstan because of the large Bitcoin mining farms, that dud led to a drop off in the mining rate. According to a Bitcoin hash rate distribution chart, Kazakhstan contributed 20% of the Bitcoin hash rate throughout the second half of 2021 and fell to a reported 13.0% after the demonstrations. The government’s move to shut down the internet in response to the Bitcoin mining farms’ energy consumption sparked debate among cryptocurrency enthusiasts. Some argued that the government’s actions were justified in addressing the environmental impact of mining, while others criticized the crackdown as a hindrance to the growth of cryptocurrency in the country. Despite the setbacks, the top crypto pump channel continued to discuss the potential for Kazakhstan to establish legal frameworks that could support sustainable and responsible Bitcoin mining practices.

In the end, it did not matter really.

Beginners Guides

Blockchain for Dummies

There are scarcely any technologies that create as much buzz as Blockchain. Since its emergence in 2008, Blockchain continues to be a hot topic among tech enthusiasts, often hailed as a transformative power in various industries.

So, what is Blockchain? In its simplest form, it is a digital ledger that records transactions sequentially and securely. This data can be accessed by anyone with the right permissions, making it highly transparent. However, what sets Blockchain apart is that it is decentralized, meaning that it is not controlled by any one entity.

This makes it incredibly secure, as there is no single point of failure. For these reasons, Blockchain is often seen as a potential solution to many of the issues faced by traditional systems, such as fraud and security breaches. With so much potential, it is no wonder that Blockchain is one of the most talked-about technologies today.

Blockchain for Dummies

A blockchain is a database that is shared among a network of computers. It allows for secure, decentralized, and tamper-proof storage of data. The most famous use case of blockchain is for Bitcoin, but the potential applications of blockchain extend far beyond cryptocurrency. Blockchain has the potential to revolutionize many industries, from banking to supply chain management. One potential impact of blockchain technology is in the healthcare industry, where it could revolutionize the way patient data is stored and shared, ensuring privacy and security. Additionally, blockchain technology could play a significant role in the voting and election process, providing a secure and transparent way to record and verify votes. The potential blockchain technology impact is far-reaching and continues to be explored in various sectors.

Understanding how blockchain works are essential to understanding its potential implications. Blockchain works by creating a digital ledger of transactions. This ledger is then replicated across the entire network of computers, each of which verifies the accuracy of the ledger. Because the ledger is distributed and verified by many different computers, it is very difficult to tamper with. This makes blockchain an ideal platform for transactions that need to be secure and transparent.

Blockchain is NOT …

Most people have heard of blockchain, but many still don’t fully understand what it is or how it works. As a result, there are a lot of misconceptions about what blockchain is and what it isn’t.

One of the most common misconceptions is that blockchain is anonymous. However, this isn’t strictly true. While blockchain does provide a certain degree of anonymity, all transactions are publicly visible on the ledger. This means that it’s possible to trace a transaction back to its origin point. As a result, blockchain is more accurately described as being pseudonymous rather than anonymous.

Another misconception about blockchain is that it’s untraceable. Again, this isn’t quite accurate. While blockchain technology doesn’t require the personal information to be attached to transactions, all transactions are publicly visible on the ledger. This means that it’s possible to trace a transaction back to its origin point. So while blockchain isn’t quite as traceable as traditional banking systems, it’s not entirely untraceable either.

Finally, some people believe that blockchain is invulnerable to hacking. However, this simply isn’t the case. While the decentralized nature of blockchain makes it more difficult to hack than traditional systems, it’s not impossible. In fact, there have been several high-profile hacks

Blockchain Is Not a Cryptographic Codification

Blockchain is a distributed database that allows for secure, transparent and tamper-proof transactions. The technology was originally developed for the digital currency Bitcoin but has since been adopted by a variety of industries. While blockchain is often associated with cryptography, the two are not the same. Cryptography is a branch of mathematics that deals with encrypting and decrypting data. Blockchain, on the other hand, is a database technology that uses cryptographic techniques to secure data. As such, blockchain is not a cryptographic codification but rather a tool that can be used to enhance security. In an era of increasing cyber threats, blockchain provides a much-needed layer of protection for businesses and individuals alike.

Blockchain is not a form of artificial intelligence (IA) or machine learning (ML)

Despite the hype, blockchain is not a silver bullet for every problem out there. In particular, it is not a form of artificial intelligence (IA) or machine learning (ML). Blockchain is a distributed database that allows for secure, transparent and tamper-proof transactions. IA and ML, on the other hand, are technologies that enable computers to learn from data and make predictions. They are often used together to create “smart contracts” that can automatically execute transactions based on certain conditions. However, blockchain is not capable of powerING these contracts on its own. As a result, while blockchain is a potentially valuable tool, it should not be seen as a panacea for all ills.

Blockchain Is Not a Cryptocurrency

Contrary to popular belief, blockchain is not a cryptocurrency. Rather, it is a digital ledger that records transactions. Cryptocurrencies such as Bitcoin and Ethereum use blockchain technology to track transactions.

However, blockchain can also be used to track other types of data, such as medical records or vote counts. The advantage of blockchain is that it is distributed, meaning that it is not stored in a central location. This makes it difficult to hack or tamper with the data. As a result, blockchain is considered to be very secure. In addition, blockchain is transparent, meaning that all users can see the transaction history. This makes it ideal for tracking data that needs to be public, such as vote counts. So while blockchain is often associated with cryptocurrencies, it has many other potential uses.

Blockchain Is Not a Python Library or Framework

Contrary to popular belief, blockchain is not a Python library or framework. Rather, it is a distributed database that maintains a continuously growing list of ordered records called blocks. Each block contains a timestamp and a link to the previous block. Bitcoin, the first and most well-known blockchain application, uses this structure to maintain a public ledger of all transactions. Because blockchain is decentralized and tamper-proof, it has the potential to revolutionize many industries, from finance to healthcare. However, Python developers should be aware that there are no ready-made libraries or frameworks for building blockchain applications. Nevertheless, with a little bit of effort, it is possible to use Python to create powerful blockchain applications.

Blockchain Is Not a Programming Language

One common misconception about blockchain is that it is a programming language. However, this is not the case. Blockchain is a platform that can be programmed using different languages, such as C++, Java or Python. As a result, it is wrong to think of blockchain as a language in its own right. Instead, it should be thought of as a tool that can be used to create secure and transparent applications.

The Blockchain: What Is It?

Blockchain is a digital ledger of all cryptocurrency transactions. It is constantly growing as “completed” blocks are added to it with a new set of recordings. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Bitcoin nodes use the blockchain to differentiate legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

The blockchain is seen as the main technological innovation of Bitcoin since it stands as proof of all the transitions on the network. A block is the “current” part of a blockchain, which records some or all of the recent transactions. Once completed, each block goes into the blockchain as a permanent database. Each transaction is then authenticated and verified multiple times by other computers on the network. The verified block is added to a sequence, creating a chain.

This time-stamping and chaining of blocks creates tamper-proof evidence, which can be inspected by anyone at any time. Because each successive block depends on the one before it (like links in a chain), it becomes progressively harder to alter transaction data retrospectively without first changing all subsequent blocks – which would require an enormous amount of computing power and money. Bitcoin miners are tasked with verifying and committing blocks of transactions to the Bitcoin blockchain. Ethereum miners are rewarded based on their share of work done, rather than their share of the total number of blocks mined.

Is There More Than One Type of Blockchain?

The term “blockchain” is used to refer to a variety of different things. Most commonly, it is used to refer to a digital ledger that records transactions. Blockchains can be public or private.

Public blockchains are open source and anyone can join them. Private blockchains are hosted on private servers and the software is proprietary. There are also consortium blockchains, which are run by a group of organizations.

The best-known example of a blockchain is the Bitcoin blockchain, but there are many others. Ethereum, for example, is a popular platform for building decentralized applications. Blockchains can be used for a variety of purposes, including tracking ownership, verifying identity, and more.

Benefits of Blockchain

In our current system, there are many points of failure. When you want to transfer money, you have to trust that the bank will properly execute the transaction. You have to trust that the government won’t seize your assets or block the transaction.

You have to trust that the person you’re sending the money to is who they say they are, and that they won’t simply disappear with your money. The current system is inefficient and insecure, and it relies on outdated technology. Blockchain provides a solution to all of these problems.

With blockchain technology, transactions are transparent and secure. There is no need to trust a third party to execute the transaction because it is done automatically and securely on the blockchain. And because blockchain transactions are transparent, you can be sure that the person you’re sending money to is who they say they are.

Blockchain is a more efficient, secure, and transparent way to conduct transactions. It has the potential to revolutionize the financial sector and is already beginning to do so.

Blockchain Disrupting Industries

It’s no secret that blockchain technology is currently disrupting a variety of industries. From finance to healthcare, this innovative technology is changing the way businesses operate and data is exchanged. One of the most notable aspects of blockchain is its ability to eliminate intermediaries. In many industries, there are middlemen who either charge fees for their services or who monetize trust.

By using blockchain, businesses can cut out these intermediaries and save money. Additionally, blockchain offers a secure and transparent way to exchange data. This is particularly beneficial in industries where data security is paramount, such as healthcare. With blockchain, businesses can be sure that their data is safe and protected from cyberattacks. As more businesses begin to adopt blockchain technology, it’s clear that this disruptive force is here to stay.

The blockchain is already disrupting industries such as banking and payments, online data storage, and even the way that we vote. In the banking sector, blockchain technology gives financial services access to the “unbanked” of the world. It will make the monetary system more transparent for the “banked” people as well.

Most banks are also developing their own blockchain solutions as it will make their operations faster, more secure, and more efficient. When it comes to online data storage, blockchain makes data safer by removing failure points. It will also create even more cost-effective storage options.

Finally, blockchain is changing the way that we vote by making the process more secure and transparent. These are just a few of the many industries that are being disrupted by blockchain technology.

What is Bitcoin?

Bitcoin is a decentralized cryptocurrency that uses blockchain technology to enable instant peer-to-peer transactions. Bitcoin is the first and most well-known cryptocurrency, and its success has led to the creation of hundreds of other digital currencies, collectively known as altcoins.

Bitcoin is a decentralized cryptocurrency that uses blockchain technology to enable instant peer-to-peer transactions. Bitcoin is the first and most well-known cryptocurrency, and its success has led to the creation of hundreds of other digital currencies, collectively known as altcoins.

What is Ethereum?

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third-party interference. Ethereum is different from Bitcoin in that it allows for the creation of decentralized applications (apps) on its platform. These dapps can be built on top of Ethereum and run on the Ethereum Virtual Machine, a decentralized platform that can execute code exactly as it is written.

What is a smart contract?

A smart contract is an immutable program that runs on the Ethereum blockchain. Smart contracts are often likened to vending machines; they take in input, process it, and produce an output. However, unlike vending machines, which can only perform simple transactions, smart contracts can be programmed to do anything that can be done in code.

Blockchain Is Decentralized. Why is it Critical?

Bitcoin is often lauded for its decentralization, but what does that actually mean? In simple terms, decentralization means that no single entity has control over the network. Instead, the network is run by a global network of computers, each of which is running the same software. This setup has a number of advantages.

First, it makes the network extremely robust and resistant to outages. If one computer goes offline, the rest of the network can continue to operate normally. Second, it makes the network incredibly secure. If all of the world’s power went out, computers would still have a copy of the ledger from when it was last updated.

And third, it gives users total control over their data. No centralized authority can censor or interfere with transactions on the blockchain. As a result, decentralization is a key feature of blockchain technology that makes it immensely powerful and valuable.

1994: “Today Show”: “What is the Internet, Anyway?”

What Is Blockchain?

Beginners Guides

How Long Does It Take to Mine 1 Bitcoin?

Imagine this scenario: you’ve just scored big time and landed 10 Bitcoins! Think about what it would take to mine those same 10 Bitcoins – can you estimate the amount of time needed?

Mining 1 BTC doesn’t take a lot. We can assume that you have powerful hardware available with you. You need to know about bitcoin mining, how the process works, and what you need to do it. It’s not something anyone can just go out and start doing.

How Long Does It Take to Mine 1 Bitcoin?

There are specific hardware requirements as well as having a secure place with both a stable internet connection and electricity. You can’t just go out and purchase the best hardware to mine BTC at home (also, unless you live in an area with very cheap electricity, it wouldn’t be worth the investment).

Mining is also not as simple as turning on your computer or laptop and then watching the Bitcoins stack up into your wallet. Most mining nowadays is done by large-scale companies that have the best hardware available to them, multiple computers that are constantly running and solving problems just like you would if you were trying to mine for yourself.

When it comes down to it, there’s a lot of work involved when wanting to mine just 1 BTC. Yes, it is possible to mine for yourself, but it’s not feasible when you’re trying to mine a decent amount. It really does take too much work and too much money.

Bitcoin mining is a process that takes time and effort. The amount of time it takes to mine one Bitcoin varies depending on the mining hardware you are using, your mining pool, and how lucky you are.

Conclusion

How Long Does It Take to Mine 1 Bitcoin? Mining 1 BTC doesn’t take a lot. You need to have powerful hardware and be part of a mining pool. It can take weeks, or even months to mine one Bitcoin. For those who don’t have access to powerful hardware, desktop CPU mining can also be an option, but it will take much longer to mine 1 Bitcoin. The mining process involves solving complex mathematical problems, and the more powerful your hardware, the faster you can solve these problems. However, with the increasing difficulty level and competition in the mining industry, it can still take a significant amount of time to mine 1 Bitcoin, even with the most advanced equipment.

Bitcoin

1 in 1.3 Million: Bitcoin Solo Miner Beats Chance To Mine A BTC Block

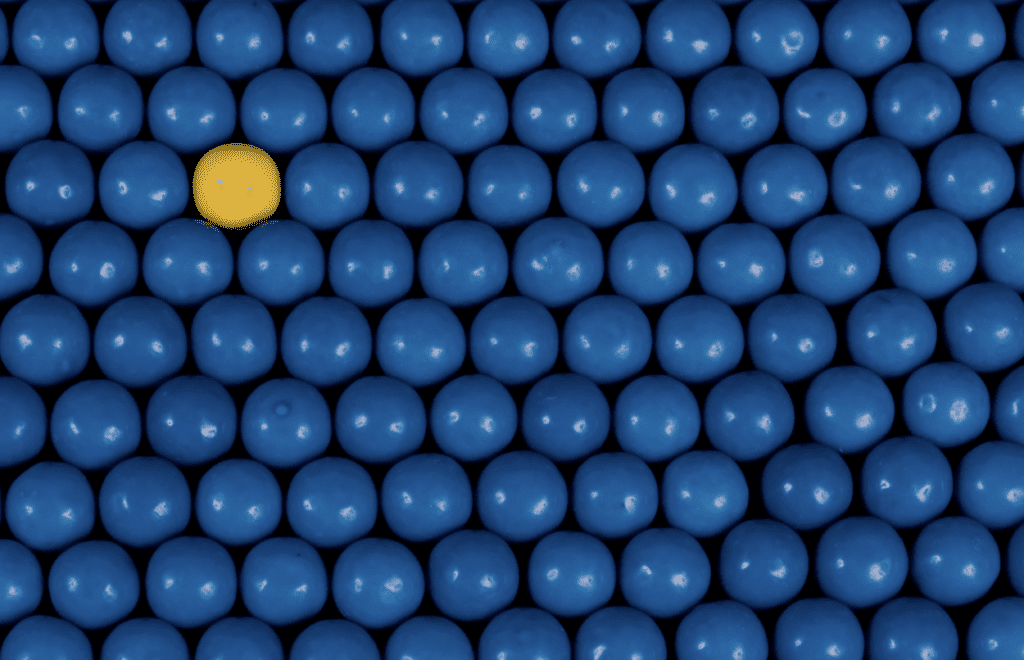

A Bitcoin miner achieved a rare victory, overcoming the 1 in 1.3 million odds to mine a Bitcoin block successfully. The endeavor of mining Bitcoin is notoriously expensive and intensely competitive. However, the reward differs among miners, with the primary goal being the acquisition of Bitcoin blocks. The Bitcoin network makes adjustments so that, on average, BTC blocks are mined every 10 minutes, a rate that matches the current worldwide hashing power of 25 trillion hashes per second. As a result, solo miners face a daunting one-in-1.3 million chance of discovering a new block, positioning them at an advantage over pool miners who share their profits within a larger cohort.

Solo Mining 260k USD with 0.0000007% Bitcoin Network’s Hash Rate

When the odds were stacked against them, the miner won the bitcoin mining lottery. The hash rate of the solo miners amounts to just 0.0000007% of the entire Bitcoin network’s hash rate. Bitcoin mining is the process by which miners compete against each other to be the first to verify a hash that is below the network’s threshold.

The more hashes a miner can complete each second, the more likely they are to discover a valid block and broadcast it to the network, which is why they can test many possibilities each second. Even tiny miners can win the jackpot if the hash function generates a wide range of hashes dependent on even modest changes. Miners frequently modify the nonce and the transactions included in an attempt to discover the ideal blend of inputs that will result in a genuine hash.

Solo Bitcoin Miner 6.25 BTC Mines Reward

A Bitcoin solo miner with only 120 trillion hashes per second (TH/s) found a new Bitcoin block – beating the one-in-1.3 million odds! This goes to show that solo Bitcoin mining is still a viable option for those willing to put in the extra work, even when the global hashing power is as high as it is now.

After successfully mining a new block on the Bitcoin blockchain, an individual miner made over $260K in wages. The fee is paid by the miner in order for a block to be accepted into the pool’s blockchain. The miner must pay a 2% fee to the pool, which equals BTC 0.125 or about USD 5,337.

Dr. Con Kolivas tweeted “Congratulations to a bitcoin miner with only 126TH who solved a solo block on http://solo.ckpool.org see Block“

6.25 BTC Reward for a Little Mining FArm

Does this mean that Bitcoin solo miners have a chance of finding new Bitcoin blocks even when the global hashing power is as high as it is now?

The answer to this question is a clear no or maybe yes, Bitcoin solo miners can still find new Bitcoin blocks when the global hashing power is high. However, the chances of finding a new Bitcoin block are lower when the global hashing power is high. This is because there are more Bitcoin miners competing for blocks when the hashing power is high. Therefore, it takes longer for Bitcoin solo miners to find a new Bitcoin block when the hashing power is high.

Conclusion – Small Bitcoin Miner Beats the Odds

When the odds were stacked against them, the miner won the Bitcoin Mining lottery. The hash rate of the solo miners amounts to just 0.0000007% of the entire Bitcoin network’s hash rate. Bitcoin mining is the process by which miners compete against each other to be the first to verify a hash that is below the network’s threshold.

The more hashes a miner can complete each second, the more likely they are to discover a valid block and broadcast it to the network, which is why they can test many possibilities each second. Even tiny miners can win the jackpot if the hash function generates a wide range of hashes dependent on even modest changes. Miners frequently modify the nonce and the transactions included in an attempt to discover the ideal blend of inputs that will result in a genuine hash.

A solo miner with only 120 trillion hashes per second (TH/s) found a new Bitcoin block – beating the one-in-one-point-three-million odds! This goes to show that solo Bitcoin mining is still a viable option for those willing to put in the extra work, even when the global hashing power is as high as it is now.

-

Cryptocurrency3 months ago

Cryptocurrency3 months agoDon’t Miss Out! How to Know Which Crypto Coin Will Pump Next!

-

Cryptocurrency2 months ago

Cryptocurrency2 months agoWhich Crypto Will Pump Next? Get the Insider Scoop!

-

Cryptocurrency3 months ago

Cryptocurrency3 months agoDiscover the Best Crypto Pump Finder Tool

-

Cryptocurrency3 months ago

Cryptocurrency3 months agoCrypto Skyrockets Overnight! Discover Why the Market Is Pumping Today!

-

Cryptocurrency3 months ago

Cryptocurrency3 months agoThese Are the Biggest Crypto Pumps of All Time – See the List!

-

Cryptocurrency3 months ago

Cryptocurrency3 months agoFind the Next Big Crypto Pump With This Amazing App!

-

Cryptocurrency2 months ago

Cryptocurrency2 months agoWhy Crypto Pump Today? The Real Reason Behind the Surge!

-

Cryptocurrency2 months ago

Cryptocurrency2 months agoWhy Does Crypto Pump at Night? The Secret Strategy Revealed!